Barclays Holiday Home Mortgage

A Guide to Holiday Let Mortgages

See how expert advice could help secure your Holiday Let mortgage

No impact on credit score

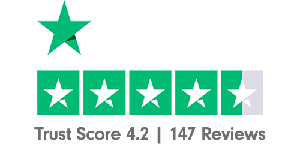

4.8 out of 5 stars across Trustpilot, Feefo and Google! Our customers love Online Mortgage Advisor

With the success of holiday property-letting sites such as Airbnb, more people are looking at how they can capitalise on this and rent their property out to holidaymakers.

You usually have two options for a holiday let mortgage: buy a residential home that you let out occasionally, or purchase a second home with the intention of renting it out to holidaymakers on a more regular basis.

While the former is typically more straightforward to arrange because it's similar to a standard mortgage, you can definitely find a mortgage provider who can approve a second mortgage.

The advisors we work with can give you the right advice and answer all of your questions and more about the advantages, disadvantages, and lending criteria of holiday buy to let mortgages.

We answer questions about what interest rates are available, how much deposit you need, and the one on everyone's lips … how profitable can buy-to-let holiday homes be?

If you want to save time, hassle and money, skip the reading and call 0808 189 2301 or make an enquiry for a free, no-obligation chat instead.

We'll match you with one of the whole-of-market brokers we work with. They will be happy to answer your questions and help find the right mortgage solution for you, at the best available price.

Holiday let mortgage criteria

A holiday let mortgage is ideal for those wanting to buy a property to rent out to holidaymakers on a short-term basis. It's typically only available via specialist lenders with specific criteria that needs to be met, and the type of holiday let mortgage you'll get will also depend on whether you're looking to buy overseas or in the UK.

The criteria you'll be expected to meet could include:

- Minimum income: Some mortgage lenders require between £10,000 to £25,000, while others will ask for £40,000. This usually must not come from other rental income

- Loan size:Many providers won't go below £40k or above £1m for individual properties

- Loan-to-value (LTV): You could be expected to put down a 25% deposit, so 75% LTV

- Applicants: Some lenders require a minimum age of 21. Others don't require a maximum age while others set a limit of 85. Many lenders require applicants to be an existing owner-occupier.

- Maximum portfolio size: Some providers state 3, 4 or even 10 properties mortgage with the Society. They could also have a maximum combined worth, for example, £3m

- Rental coverage: Certain lenders state at least 140% (of mortgage interest payment) based on the initial stress rate

Can I get a holiday let using a normal mortgage?

A holiday let mortgage in the UK is similar to a standard mortgage, but not the same, and you would usually not be permitted to use a standard residential mortgage to rent out the property as a holiday let.

If you already have a mortgage on your home, then the holiday let mortgage may be deemed to be a 'second mortgage' if you plan on living in it half the time and not letting it out. If this is the case there will be restrictions on who can/can't stay there, how often you are there, and the loan to value lenders are willing to consider.

If you intend to use the holiday home exclusively and don't intend to let it out, some lenders will still allow lettings up to 18 weeks a year. In this case, it may be possible to use a standard mortgage.

Can I use a buy-to-let mortgage for a holiday let?

In almost all cases, you can't use a standard 'buy to let' mortgage, as a 'buy to holiday let mortgage" is usually treated as a business and let to temporary guests, whereas most Buy to let lenders require the property to be let to tenants on an assured tenancy agreement.

The right buy to let mortgage broker will assess your circumstances, will have access to the whole market, and have experience of regularly arranging holiday let mortgages. Make an enquiry and we will refer you to the expert be best placed to give you the right advice.

Speak to a Holiday let expert

Holiday let mortgage rates

Comparing the best holiday let mortgages can show higher rates than a standard mortgage because it is something of a niche market, with slightly more perceived risk – fewer lenders means less competition.

The rate you'll qualify for depends on numerous factors, generally:

- the amount of deposit (the more the better)

- the rental income you expect

- your credit history

- your income and age

- the property type (the more standard the better)

- various other factors

Again, one of the mortgage advisors we work with can give you the right may be able to get you the best holiday let mortgage rates.

Holiday let interest-only mortgages

Some lenders offer interest-only holiday let mortgages and, depending on your circumstances, these products may be more suitable for you. Your intentions as to whether you are living in the property exclusively, or want to let it out will play a part.

If you'll let out the property

In general, if you are letting the property and will be using a buy to holiday let mortgage, lenders will be happy to consider on an interest-only basis as standard, with no real need for another repayment strategy (your plan to pay off the mortgage before the end of the term) than selling the property.

If the holiday home is on a second residential mortgage

If you are going to live in the property exclusively and use a standard second home residential mortgage, lenders are much more likely to want to see a viable repayment strategy (which may be selling the property, or another vehicle such as savings/investments/pension lump sums etc.).

We're so proud of our customers

See how our customers managed to borrow more after they were matched with a specialist broker.

Bob and Myriam

My wife and I aren't far off retirement and thought it would be nice to buy a holiday apartment in the Lake District but neither of us knew how a second mortgage worked. We turned to Online Mortgage Advisor for guidance and they didn't disappoint, and quickly found us a lender who was willing to offer us a great deal on a mortgage for the apartment and guided us through the remortgage process

Ryan

I'd been making rental income from an inherited property for a while, but this year, I decided to have a go at starting my landlord business. Habib at OMA helped me start small by remortgaging my buy-to-let agreement to generate money to buy another rental property.

How much deposit do I need for a holiday let?

When you buy a holiday let to run as a business, versus a holiday home to use yourself exclusively, deposits can vary. Typically most lenders will require 25% deposit if being let and at least 15% if exclusively for you to use. Some lenders are more flexible and can consider as little as 15% for a let property and 10% for a second home holiday let.

How much can I borrow on a Holiday let mortgage?

Although there is no specific Holiday let mortgage calculators, affordability varies depending on whether you plan to rent the property out as a business; or live in it exclusively.

Affordability if you are renting the property out

These mortgages tend to be arranged as a type of buy to let mortgage and are calculated based on the rental income of the property.

Now, if you plan to rent out the property, while your buy to let holiday business may experience very good income in the high season, this can be much lower at other times.

So, lenders tend to look at the actual rental income over the whole year to assess affordability. You'd, of course, need to bear this in mind for budgeting purposes, as the mortgage payments are likely to be consistent over the year!

Some holiday let mortgages lenders require that your net annual rental income be a minimum of 125% of the annual mortgage interest, (so for a mortgage payment of £500 a month, the rental income must be at least £625), and ranges up to 170% (£850) for specialist mortgages and lenders.

This can be different lender to lender and depending on whether you are a higher or lower rate taxpayer, or whether the property is in an Ltd company wrapper.

If the rental is not enough to cover this, some lenders allow landlords to use their personal income to cover the shortfalls – this is known as ' top-slicing' . Lenders would almost always want the applicant to have their own personal income as well, some placing minimum limits of £20-30k a year, with others more having no minimum limit.

The real question is … could you afford the buy to let holiday mortgage if it was only let for a month? Or not let at all? All important considerations. So you can see why it's important to get the best buy to holiday let mortgage.

Affordability if the holiday home is just for you

If you are living in the holiday home, mortgage affordability is calculated differently and is based on your personal income and outgoings.

Most lenders will want to know you can afford the mortgage alongside any other mortgage, loan, credit card commitments, and lend to a limit of around 4x your annual income. Some lenders can lend up to 5x, and a handful up to 6x in the right circumstances.

Calculating holiday let mortgage affordability becomes a little more complex, when you are a professional landlord or self-employed in another capacity, as evidencing acceptable income can be more complex – as lenders all have a different policy on acceptable trading style, time trading, accounting figures used etc.

The good news is there are lenders that specialise in holiday let mortgages for self-employed people, so make an enquiry and one of the experts will give you the right advice.

Rated excellent by our customers

Where is the best place to get a holiday let?

You also need to consider a number of other factors, such as the best place to buy a holiday let, how popular the area is with visitors and who will look after the property when you are not there, are important issues that may affect where you buy.

The amount of income you can generate is dependent on your pricing policy, type of home, location, actual occupancy rate, seasonal demand and type of guests.

For example, if your net rent is £10,000 and the property cost £200,000, then the yield is 10,000/200,000 which equals 0.05 x 100 = 5% yield.

Something to consider is that the average occupancy is around 21 weeks, with more popular areas having occupancy of around 24 weeks and a holiday home in the Lake District can be a whopping 40+ weeks.

Some of the most sought after features that will boost revenue is –

- Weather

- Location

- Local amenities (Pubs, restaurants attractions etc.)

- Open fireplace

- Swimming pool

- Hot tub

- Sea/water views

- Beach within 5 miles

- Internet

- Dog friendly

Do lenders have different criteria for holiday let mortgages in Scotland and Northern Ireland?

All lenders are different and will have different criteria depending on your circumstances, such as income, deposit and credit history.

This is why you should talk to one of the advisors we work with who are experts on holiday let mortgages in Scotland and mortgages in Northern Ireland.

We're so confident in our service, we

guarantee

it.

We know It's important for you have complete confidence in our service, and trust that you're getting the best chance of mortgage approval. We guarantee to get your mortgage approved where others can't - or we'll give you £100*

Buy-to-let landlords move in on Airbnb

Before you buy a holiday home to let, a good tip would be to have a chat with a local holiday letting agent for their assessment of rents in the area; or go onto Airbnb to get a feel for the sort of rents people are asking for in a similar property.

Airbnb was founded in 2008 and has proven a boon to many landlords with buy to let holiday homes. The company operates an online booking service for people looking for short term holiday homes, cottages, apartments etc.

Putting your holiday buy to let on Airbnb could take a lot of the hassle out of marketing your buy to let or holiday let.

Obviously, the more popular the area, the more bookings you will receive, so where you'll buy a holiday let in the UK is an important consideration.

Getting a mortgage on a unique/non-standard holiday let property

When it comes to the style and construction of the building, the holiday let mortgage criteria generally dictates that property is of standard construction; so that yurt or tree-house you have your eye on, probably won't impress many holiday let mortgage lenders.

Standard construction tends to be brick built with a slate or tile roof, which if in a good state of repair will usually be approved by lenders no problem. There are also lenders considering concrete, timber or steel framed property and a whole number of variations that are generally assessed individually and is not until a valuer formally reviews the property that the buyer will know the likelihood of it being suitable for lending purposes.

If you want to get the best returns on your holiday home, you'll need to run it like a real business; so you'll have to market your home, look after your guests, keep the home clean and attend to any maintenance quickly, or have an agent/ someone run this for you of course.

Do buy-to-let holiday cottage mortgages have different criteria?

All lenders are different, but the criteria for cottages is much the same to any other standard construction property, as long as it doesn't have a thatched roof.

Buildings with an unusual or non standard structure sometimes require a specialist mortgage lender as they can be viewed as a higher risk to some lenders.

Speak to one of the expert brokers we work with and they will be able to help you find the right mortgage solution at the best available price, taking all your circumstances into account.

Make an enquiry for a free, no obligation chat.

Does the holiday let need to be furnished for a mortgage?

Yes, if you're looking for a mortgage on a holiday let business, then most lenders will require that it be a fully furnished holiday let.

Speak to a Holiday let expert

Holiday let property tax

The 'buy to let' boom was primarily fuelled by the tax advantages offered to landlords, but now, government legislation to reduce these advantages has changed the market significantly. That said, for many, there are still considerable gains to be made.

Holiday let mortgage vs. buy-to-let

The good news is that for many people, these new laws do not affect holiday homes that qualify as Furnished Holiday Lets (FHLs), so your buy and let holiday cottage or home may still enjoy the original tax breaks, subject to certain criteria.

Bear in mind that for tax purposes there are quite strict criteria to be met. For instance, it must be available to let for at least 210 days a year and you'll need to let it out for at least 105 days.

This means you could potentially claim expenses such as maintenance and your holiday let mortgage interest against rental income. You need to consult an accountant or tax advisor, who should be able to provide full details.

Remember, if the primary reason for buying a holiday home to let is for annual family holidays, then it also needs to be a place that you'd love to visit, time and time again without getting bored.

Speak to a holiday let mortgage expert.

If you have questions and want to speak to an expert for the right advice, call Online Mortgage Advisor today on 0808 189 2301 or make an enquiry here.

Then sit back and let us do all the hard work in finding the broker with the right expertise for your circumstances. – We don't charge a fee and there's absolutely no obligation or marks on your credit rating.

Ask a quick question

We can help!

We know everyone's circumstances are different, that's why we work with mortgage brokers who are experts in Buy to Let Mortgages

Ask us a question and we'll get the best expert to help.

![]()

Related Articles

Continue Reading

*Based on our research, the content contained in this article is accurate as of the most recent time of writing. Lender criteria and policies change regularly so speak to one of the advisors we work with to confirm the most accurate up to date information. The information on the site is not tailored advice to each individual reader, and as such does not constitute financial advice. All advisors working with us are fully qualified to provide mortgage advice and work only for firms who are authorised and regulated by the Financial Conduct Authority. They will offer any advice specific to you and your needs.

Some types of buy to let mortgages are not regulated by the FCA. Think carefully before securing other debts against your home. As a mortgage is secured against your home, it may be repossessed if you do not keep up with repayments on your mortgage. Equity released from your home will also be secured against it.

Source: https://www.onlinemortgageadvisor.co.uk/buy-to-let-mortgages/holiday-lets/